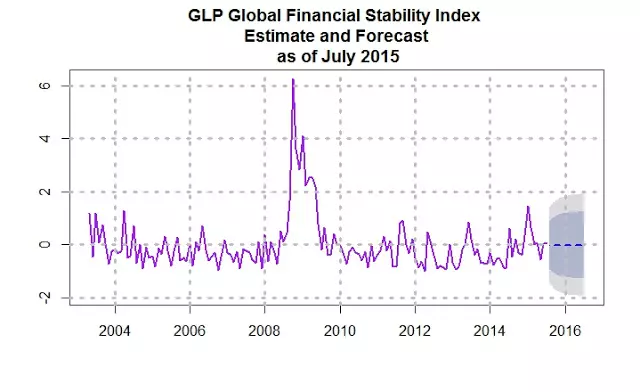

Introducing the GLP Global Stability Index (c) The Index Shows Moderate Volatility Ahead

This Week I want to introduce a new financial stability indicator, the GLP Global Financial Stability Index©. The index is based on the returns of global assets, the spread between junk bonds and 10 year treasuries, and the yield curve. There were 17 assets/variables in total. In addition, I provide a three month forecast.

Since the index is normalized, with a zero mean and a standard deviation of one, the index is in units of standard deviation. The higher the index, the more volatile are global markets. Index levels around zero indicate an average level of volatility based on the 2003 to 2015 period. Levels below zero indicate periods of relative calm. A couple of observations: in 2009 the index was over six standard deviations indicating an extremely high level of global volatility; the July reading is right at zero and the three month forecast has a wide error band.

The Data

The data was sourced from several places; the primary download source was Quandl. The table below shows the data and their sources. While much of the data starts in December 1999, the full data set contains 147 monthly observations and runs from May 2003, to July 2015. I used a combination of excel and R to analyze the data and produce the graph.

The data and their sources are shown below.

Data List and Sources for GLP Global Financial Stability Index ©

Asset and Type Source

Brent Crude: Commodity, Federal Reserve

Russell 1000: Equity, Frank Russell

Russell 2000: Equity, Frank Russell

Gold London fixing: Commodity, London Bullion Marketing

Silver London fixing: Commodity, London Bullion Marketing

Euro vs. USD: Currency, Federal Reserve

10 Year minus 2 year yields: Interest Rate, Federal Reserve

Guggenheim High Yield: Fixed Income, Yahoo

Trade Weighted Value of the $: Currency, Federal Reserve

High Yield minus junk bond yield: Interest Rate, Merrill Lynch

MSCI US real estate support: Real Estate, Yahoo

Shanghai Composite Index: Equity, Yahoo

IMF All Commodity Index: Commodity Index, IMF

IMF All Commodity Index: Interest Rate, Merrill Lynch

MSCI: Equity, Yahoo

MSCI: Equity, Yahoo

Templeton Global Bond: Interest Rate, Yahoo

Data Method

I used a technique known as the Mahalanobis distance measure which is a statistic that measures how far an observation is from a multivariate average. It is unique in that it uses the covariance matrix between the assets.

An Aside on Volatility Forecasts

Over the course of many years, I have developed a variety of volatility models. These models do a credible job of telling us where we have been. A quote attributed to Niels Bohr, the famous Danish physicist, is “Prediction is very difficult, especially when it’s about the future.” This applies especially to volatility forecasting. Volatility forecasts based on daily data are useful for three to five days at most.

Think about Black Monday in 1987, the internet bubble in 2000, and the financial crisis of 2008 – 2009. I am not aware of any quantitative models that predicted these high volatility events.

The practicality of the above chart is that it puts the current volatility in perspective and provides an investor with a sense of the current environment.

I plan to update this chart monthly.